Ethereum's Shanghai Upgrade: The Catalyst for a Bullish ETH Price Rally?👀

All you need to know about the new era of staking withdrawals. PLUS what has changed for the stakers and the web3 ecosystem.🤑

💲 Gm gm folks 💲

This is Bits n Bytes, the only newsletter that makes keeping up with web3 effortless!😊😊

We're here to keep you in the loop with the latest and greatest in the world of web3 and crypto.🫡

Just like Ethereum's upgrade, our newsletter is always full of energy, ready to kickstart your day, week, month, or quarter with juicy news and insights. Lesgooo🚀🚀

What’s on the menu😋:

For starters, we have all the savory details on Ethereum's upgrade 👀

For the main course, we talk about common misconceptions 😁

For desserts, we have an assortment of EIPs that can be used to incentivize certain behaviors or actions on the Ethereum network.🤩

So, buckle up and get ready to snack on some fresh crypto updates. 🆗

TLDR👇:

Ethereum's Shanghai Upgrade scores a slam dunk, propelling its price up by 6.2% and smashing through the $2,000 milestone like a boss!😲

Ethereum's staking program is now up and running, making it the ultimate package for savvy investors who want to ride the crypto wave to success!😮

Ethereum has leveled up its game as not just the world's biggest smart contract platform, but also as a trailblazer with a fully operational staking program in place.🤩

Let’s first start with understanding how we got here and Why staking withdrawals weren’t enabled when Ethereum moved from PoW to PoS?

▶️ The Merge, which was the largest change in Ethereum's history, had to be implemented without any downtime due to the nature of the upgrade.

▶️ To reduce the risk, the scope of the merge was narrowed down, and only the switch from PoW to PoS was included as part of the upgrade, with no other additional features.

▶️ The withdrawals were particularly affected and became the primary focus of the Shanghai/Capella upgrade, which aims to address this issue.👀

But, What happened after The Merge?

📌 While the Ethereum Merge update to PoS consensus enabled Ethereum to achieve a staggering 99% reduction in energy consumption, developers also believed that under PoS, the network would be more secure and would enable more decentralization. ✅

In a proof-of-stake system, users put up their cryptocurrency as a form of collateral to help secure and confirm new data blocks. In order to participate in the block validation process and secure the Ethereum network, validators have to stake at least 32 ETH by sending them to a smart contract where the funds are locked in.

However, this breakthrough came with a challenge: Ether holders who had staked their coins were unable to unlock them.

And that’s not the only problem😲

When the Proof of Stake (PoS) chain was initially launched, the cost of staking 32 ETH was approximately $15,000. However, since then, the value of ETH has skyrocketed, reaching over $67,000.

Not everyone has that amount of ETH lying around to be able to stake a full 32 ETH.😌 So liquid staking providers came to be as an alternative, where users who wanted to participate in the staking process could contribute any amount of ETH they want, and third-party providers would stake that ETH and run the validator on behalf of the collective of clients.

And that’s exactly where the Shanghai upgrade comes into the picture 👀

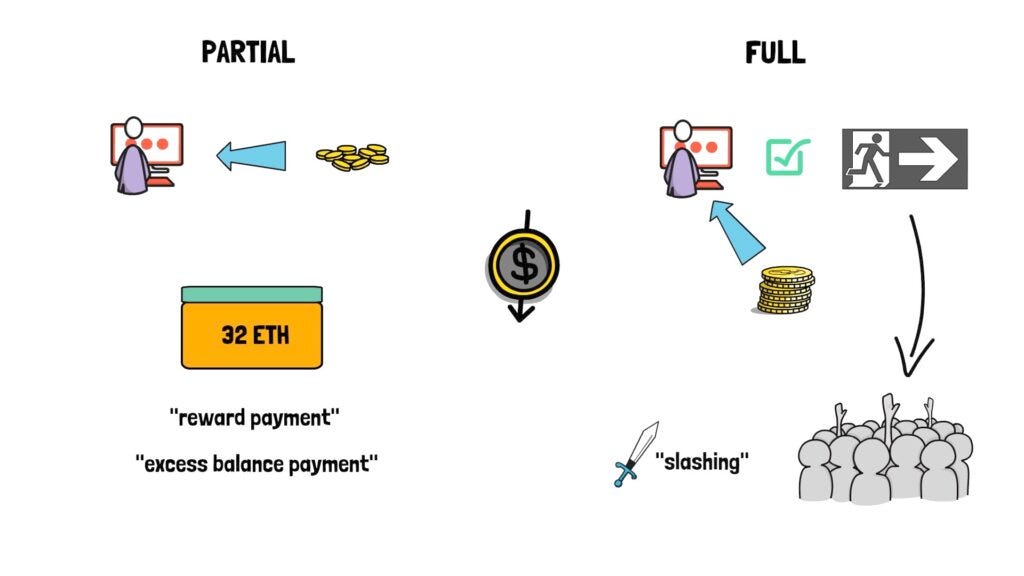

Now there are numerous ways in which validators can unstake, though the two main types of unstaking are Partial withdrawals and Full withdrawals.

📌 A partial withdrawal is when stakers take out the rewards they earned from staking but leave the original ether that was staked. Think of this as a Reward Payment 🤑

📌 Full withdrawals are where stakers also redeem their original principal - fully unstake their 32 ETH and any rewards they’ve accumulated. This occurs only when the validator exits the system either voluntarily or by being forcibly removed in a process called slashing🤔

📌 Furthermore, the withdrawal process in Ethereum is initiated at the consensus layer, eliminating the need for transaction fees at any step.

📌 To initiate the withdrawal of staking rewards, validators only need to provide their withdrawal address once. Since withdrawals impact both the consensus and execution layers of Ethereum, updates are required for both parts of the network.

The execution layer upgrade that includes withdrawals is referred to as Shanghai, as specified in EIP-4895, while the counterpart consensus layer upgrade is known as Capella. These two upgrades are sometimes collectively referred to as Shapella.

It is doubly named because it is the first simultaneous upgrade of Ethereum’s execution layer and consensus layer 🫡

So, What’s the Shanghai upgrade all about?

After a two-year lock-up period, Ethereum staking withdrawals were enabled by the Shanghai upgrade around 6:30 p.m. ET on April 12, 2023 🥳

The upgrade enables Staking withdrawals, and as the name suggests, it allows stakers to withdraw their locked-up ETH. 🤩

➡️ When the upgrade was activated, partial withdrawals became available without the need for blocks to finalize, allowing users to receive their rewards promptly.🤑

➡️However, Ethereum has a limitation of processing only 16 partial withdrawal requests in a single slot, which occurs every 12 seconds. Depending on the number of requests, the withdrawal queue could potentially take hours to clear. You’ll know why this is important shortly 🤨

➡️ Full withdrawals – where stakers also redeem their original principal – went live at the same time, allowing validators to fully unstake their 32 ETH and any rewards they’ve accumulated. Full withdrawals don’t happen automatically, so those validators that want to exit have to send a message to the blockchain to get added to the queue🫤

If an investor seeks to withdraw all their original coins and rewards, they have to go through a queue. The time it takes for the queue to be processed depends on how many people are trying to pull out their ether at the same time. It may take over 30 days to process withdrawal requests from 10% of current validators.

There are some misconceptions about this process👀

What are the implications of enabling Ethereum stakers to withdraw their locked-up ETH?

Full and Partial withdrawals are different🫣

Not really, both full and partial withdrawals occur when the validator set is scanned and a validator's index [ the index of the validator whose balance is being withdrawn ] is reached. The only difference is that for full withdrawals, the validator must leave the exit queue and reach the withdrawable_epoch [ epoch at which your validator funds are eligible for a full withdrawal during the next validator sweep ] before the linear scan can process it.

Users will lose their rewards if they do not provide a withdrawal address 😨

That’s not true, if a validator forgets to provide a withdrawal address, their ETH rewards will not be lost. Instead, the scan will simply skip over validators who haven't provided their withdrawal addresses.

⚠️ Withdrawal address cannot be changed, and it’s set only once. Therefore, stakers must be extremely careful when setting up the withdrawal address, ensuring they have full ownership of the address provided.⚠️

Stakers will withdraw a lot of ETH and destabilize PoS

Since the Beacon Chain went live in December 2020, more than 18 million ETH has been staked, that’s about 15% of the total ETH supply. Now that Shanghai is live, about 1.1 million accrued ETH from rewards is eligible to be immediately withdrawn.

We cannot fully predict how much ETH will be withdrawn over time, there are a few important counterarguments 👇👇

📍 The majority of stakers (genesis validators) are early adopters of Ethereum who took the risk of staking even when withdrawals were uncertain. Many stakers have would continue supporting the network and earning rewards denominated in ETH by continuing their staking activities.🫂

📍 In order to maintain stability in the PoS consensus mechanism and the active set of validators, Ethereum has implemented a withdrawal queue for validators who wish to exit. This queue restricts the number of validators that can leave the ecosystem at the same time. It may take over 30 days to process withdrawal requests from 10% of current validators 😐

📍 Given that enabling withdrawals will introduce a two-sided staking flow, where ETH can flow into and out of the network, this may further incentivize people to stake, as they will know they can always withdraw their ETH if they need it for other purposes.🤗

Bruh, 💸 What happens to the liquid staking market?

📌 Early adopters of liquid staking and centralized staking gained a significant market share due to limited competition. However, with the enablement of withdrawals, the market share of these established players may undergo a significant shift, particularly if they do not offer competitive rates.

📌 The freedom to easily switch between staking providers will bring benefits to the Ethereum staking market.

We know you’re eagerly waiting for the desserts, So here you go!

All about EIP-4895 and a few others 👀

P.S. We know ya’ll love some freebies 😊

EIP-4895 is a feature that will allow validators to withdraw their 32 ETH from the staking contract.

While staked ETH withdrawals are the main focus of Shanghai, there are also other smaller mechanisms to Ethereum (Ethereum Improvement Proposals or EIPs) that will improve gas fees for developers.

EIP-3651, which accesses the “COINBASE” address, a software used by validators (Not the Coinbase you’re thinking of), at a lower gas cost. This code change to the blockchain could improve Maximal Extractable Value (MEV) payments for users;

EIP-3855, which enables “Push0,” a code that will lower gas costs for developers;

EIP-3860, which caps gas costs for developers if they use ‘init code’ (a code used by developers for smart contracts)

Coming to the impending question 🙄

Will ETH price rally?

Although there is widespread consensus that the upgrade will benefit Ethereum in the long run by increasing liquidity for Ether investors and stakers, potentially stimulating institutional participation, there has been some uncertainty regarding its short-term impact on price.

We have our theories and some facts 👇

👉 Around 18 million ETH is available for withdrawal following Shanghai. However, a day after the upgrade more than 95% of withdrawals (over 172,000 Ether) were staking rewards. As of 15th April, Principal withdrawals were fairly less in comparison to reward principals👇👇

It’s worth noting that around 201.84k ETH has been withdrawn as of writing this post! The net staking balance has dipped by -2644.04%😲

👉There could be additional selling pressure from entities that are facing financial pressure.

With the queues and daily withdrawal limits in place, we’re hopeful that the benefit of enabling withdrawals will outweigh any selling pressure it might cause in the long term. 😇

👉 Nonetheless, Ether rallied above $2,000 Thursday for the first time in eight months, that’s more than 10% advance to as high as $2,130.30, its highest level since May 2022.

And it’s worth noting the basis of the withdrawing trend and the ETH price surge that the upgrade will strengthen the confidence market participants have in staking ETH to generate yield🚀🚀

In general, we expect the Shanghai upgrade to lead to a noticeable increase in new staking activities in the short to medium term.

Well, that’s a wrap for today! 😊

If you want more Web3 Gyan, then, be sure to follow us on Twitter (@Web3_BNB)

Adios 👋

How'd you like today's Web3 Bytes?

Let me know in the comments 👇