Web3 Wallets Explained - How to Choose the Best!🤩

This weeks crypto munchies - serving all the deets on which wallet to use and when👀

Gm Gm 🙏

This is Bits n Bytes. The newsletter serving up perfect snaccc plates of crypto gyaan so good it leaves you asking for more.😁

While the market hasn’t recovered from what went down with FTX, a lot of ya’ll are still looking to know What happened with FTX?🤯

Well you knew you’re going to hear about this one!😅

The whole FTX fiasco happened in a matter of few days. But in this not so simple world of crypto, this can be hard to parse. 😮💨

From revelations around Sam banking company’s money to ETH getting dumped by hackers to customers losing over over $3b - this list can go on and on.🥶

Well, the FTX crash has set the crypto space back by a few years, but if we learn our lessons right, we won’t have another FTX.🚀🚀

This was a clear example of a scam artist who used the allure of crypto to steal billions from ordinary people.

Regulated, onshore exchanges > > > offshore exchanges

Self-custody wallets - be your own safety guard. Transfer your crypto to self custody wallets.🔐

Bottom line being, FTX failed to implement good controls and lacked fruitful governance structures and ethics. A classic case of power concentrated in too few, inexperienced hands😶😶

Having said that, at the end of the day it’s your money that’s lost. It is necessary to have wallets to protect your investments, but choosing the right wallet can be confusing. 😵💫

Cryptocurrency wallets are like any other piece of software, & is prone to getting hacked, and your cryptos are as safe as your wallet. Different types of wallets differ in purpose.

Do you know how many wallets are out there and which one is the best for you?

Read on to find which wallet is right for you at different times. Let’s get snaccing!

ICYMI: A wallet is a combination of a public address and a private key.

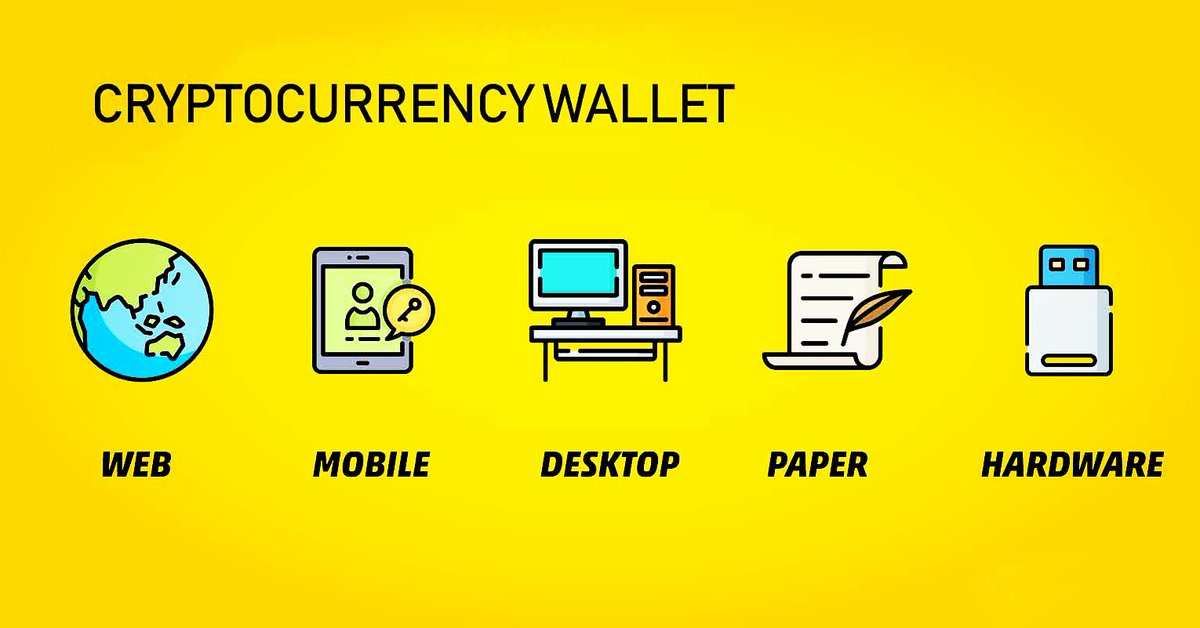

We got two basic kinds of wallets: Hot and Cold.

📌Hot wallets = connected to the Internet, hence are less secure and pose more risks but are user-friendly. It’s easy to set up, and the funds are quickly accessible. It’s more like the carry on wallet each one of us has. Web-based wallets, mobile wallets, and desktop wallets are all typically hot wallets.

📌Cold wallets = stored offline and don’t require internet connectivity. Higher security and less risk. They’re preferable for more long-term (HODLing). Cold wallets are more like a safe or a vault to hold on to more substantial sums of money.

Hardware wallets🛠️

👉Hardware wallets are hardware devices that individually handle public addresses and keys. Pretty similar to a USB with an OLED screen and side buttons.

👉It is a battery-less device and can be connected to a PC and accessed by native desktop apps. Costs up to $70- $150, but it’s worth it.

👉Definitely more secure than hot wallets and user-friendlier than paper wallets but less than web and desktop wallets.

👉Available in different forms and offer reasonable amounts of control.

👉Can be a little difficult to use for beginners, but you get a hang of it over time just how easily you’ve become the web3 OG with bits n bytes

📌Ledger Nano S and Trezor are the OG hardware wallets

Paper Wallets📜

👉It’s a physically printed QR coded form wallet. Some wallets allow downloading the code to generate new addresses offline.

👉Not prone to hacks, but the number of flaws > > > > >.

👉You can’t send partial funds. Thus, it can’t be reused.

👉They used to be very popular for cold storage, but not after hardware wallets came onto the scene.

👉With stringent security precautions, paper wallets can be set up.

Desktop Wallets🖥️

👉Bunch of install-able software packs available for operating systems .

👉Using desktop wallets without Anti-virus is like going to raft without a life jacket. 👉They’re quite a secure way to store cryptocurrencies over storing it with exchanges

📍Easy to use

📍Gives privacy and anonymity

📍No third party involvement.

🧷OG desktop wallets : Electrum, Exodus, Bitcoin core etc.

Mobile Wallets📱

👉It’s the wallet you used to get that NFT airdrop. The same wallet you used to deploy your first smart contract - Metamask is more ubiquitous now than ever.

👉Mobile wallets = desktop wallets made for smartphones.

👉They are practical and can be used on the go but prone to viruses.

📌Coinbase, Metamask, TrustWallet, Exodus are all commonly used wallets

Web Wallets🌐

👉The least secure wallets just like that once friend who you can’t trust with your secrets!

👉These wallets are accessed by internet browsers.

👉Ideal for small investments and quick transactions.

📌MetaMask and Coinbase have web wallets too!

Now that you’ve got your basics right, time for some fancy crypto snacc🍪🍩

Custodial vs Non - Custodial Crypto Wallets

With a non-custodial wallet, you have sole control of your private keys. 🔐

With a custodial wallet, another party controls your private keys. Simply put, you’re trusting a third party to secure your funds and return them if you want to trade or send them somewhere else.🏦

Which one to go for though?

Let’s weigh in our options:

Custodial

👉Most web-based crypto wallets are custodial wallets.

👉It’s very likely that the first time you purchase crypto, it will end up in a custodial exchange crypto wallet.

👉In this case, the exchange is your custodian, which holds your private keys and is tasked with securely storing your funds. It is crucial that you use a reputable custodial wallet, where the majority of customer funds are held in cold storage hardware wallets and highly secure.

👉Clearly less secure, but many prefer them because they don’t require as much responsibility and are usually more convenient. And in age where people can’t remember what they did last weekend, remembering seed phrases is a long shot!

⚠️Losing your password to a non-custodial wallet could be financially devastating if you do not take sufficient precautions.⚠️

However, if you forget your exchange account password you’ll likely be able to reset it.

Non-Custodial Crypto Wallets: Taking Personal Responsibility for Your Assets

👉Non-custodial crypto wallets give you complete control of your keys and therefore your funds. Well you got one thing in life under control.

👉Non-custodial wallets can be browser-based, they can come in the form of software installed on mobile devices or on desktops, or they can be hardware devices, among other options.

👉Hardware, non-custodial crypto wallets are one of the best ways to secure your funds.

👉Although they are technically connected to the internet during a transaction, the signing of the transaction by the private keys is done offline within the hardware wallet itself before being sent online to the blockchain to be confirmed.

👉And hence, even a malware-infected computer or phone can’t access your funds when you’re using a non-custodial hardware wallet.

🤜Both custodial and non-custodial have flaws. Blockchain only makes sense if people are in control of their crypto and if their funds are as safe as they are with banks today.

🥁 Enters Ethereum’s decentralised Smart Contract Wallets.🥁

These wallets hold your assets in a smart contract that exists on the Ethereum Blockchain.

Because smart contracts are programmable (imagine a layer of code on top of the accounts), it allows for new features (like account recovery processes) that make them safer and easier to use than funds stored on a 'normal' Ethereum account.

Say you lose your phone that holds the app with the private key, the user can restore access to the smart contract that holds the funds by following a recovery process. A new private key is created and the smart contract with the users funds is assigned to the new private key.

The recovery processes come in different shapes and forms but one popular method is called social recovery where you use your trusted contacts to receive requests that they have to confirm. After a majority confirms, the new private key becomes the new owner of the smart contract holding the funds.

What else is possible with Smart Contract wallets?🤔🤔

Transfer limits: Define the limits of how much you want to spend per day/week.

Bundle transactions: improve user experience by bundling interactions with dApps that would take several steps using a conventional wallet into one or two taps. Biconomy has an SDK for this as well

No fees: The wallet provider can choose to wave the fees associated with Ethereum transactions to simplify the user experience [Relayers as you might have commonly hearf ]

It Comes Down to How You Want to Secure Your Crypto

Choosing between a custodial wallet and non-custodial wallet is a key decision when it comes to securing your cryptocurrency holdings. Some prefer a custodial exchange account, while others prefer non-custodial wallets, while some end up using a combination of the two and more will further move to SCW.

Why? Coz they solve both problems inherent in crypto today; users stay in control of their funds while benefiting from higher security measures than they receive at their banks.🚀🚀

Regardless of your choice, be sure to always follow best security practices, and safegaurd your private keys

Well that’s a wrap for today! To better days in web3 ahead 🤞🤞

If you want more web3 gyan, then, be sure to follow us on Twitter (@Web3_BNB)

Adios 👋

See ya’ll at the Blockchain India week

How'd you like today's web3 Bytes?

Let me know in the comments

![I don't think my friend understands the security behind a paper wallet...[PIC] : r/Bitcoin I don't think my friend understands the security behind a paper wallet...[PIC] : r/Bitcoin](https://substackcdn.com/image/fetch/$s_!jUlN!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F4e3b52f9-b66f-4949-b5bb-4019ef508f24_480x360.jpeg)

Easy to understand and informative! Thank you Laisha!